Medium-Term Management Plan

Outline

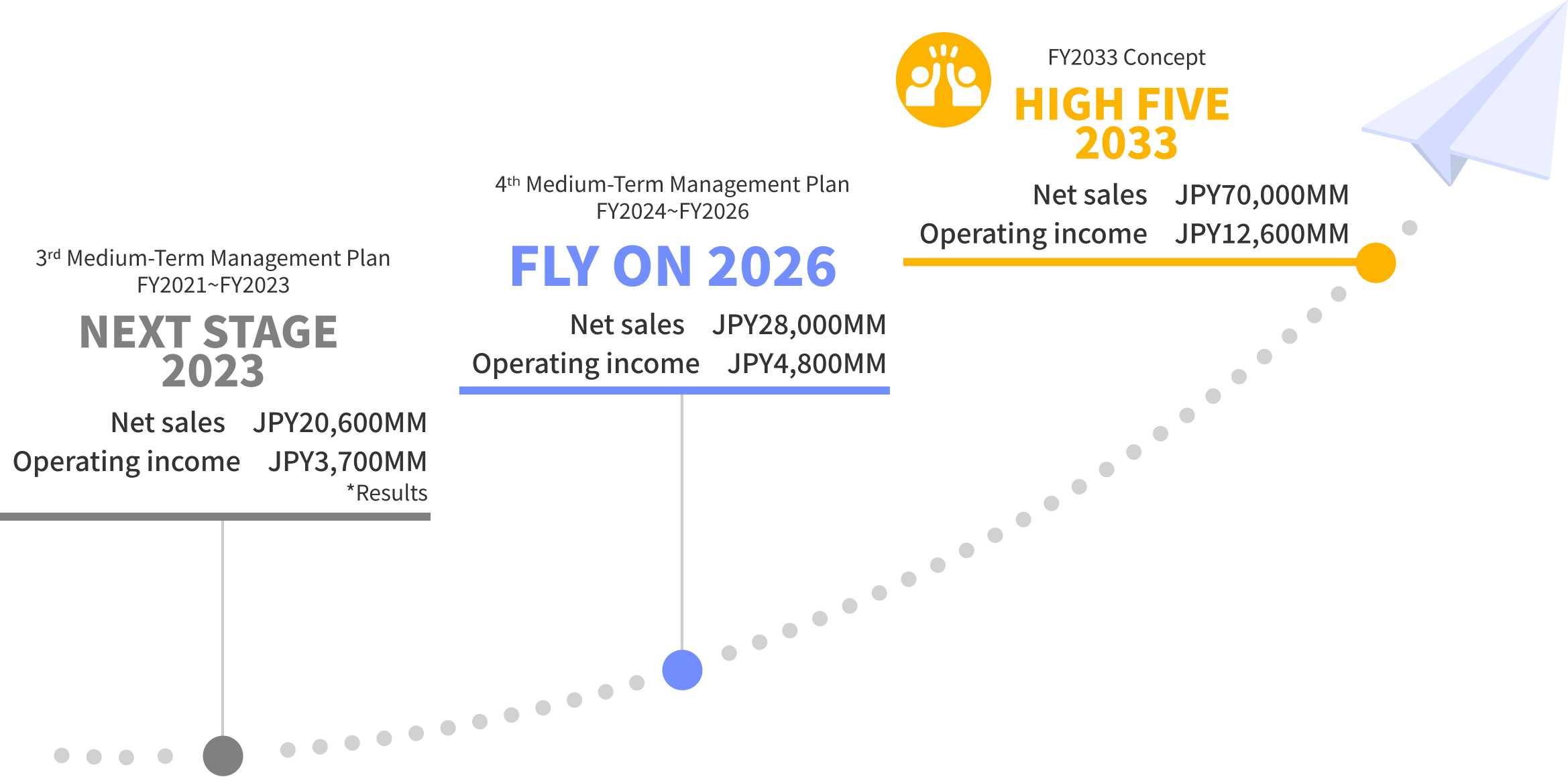

To achieve the FY2033 concept “HIGH FIVE 2033”, we have formulated “FLY ON 2026”, our 4th Medium-Term Management Plan for the three years from FY2024 through FY2026, using a backcasting approach.

Financial Targets

| FY2023 | FY2026 (Targets) | ||

|---|---|---|---|

| Net sales (JPY MM) | 20,652 | 28,000 | Net sales CAGR 10.7% |

| Operating income (JPY MM) | 3,737 | 4,800 | Operating income CAGR 8.7% |

| Operating Income Margin (%) | 18.1 | 17.1 | |

| ROE (%) | 15.4 | 15.0 | Maintain high levels of ROE and ROIC |

| ROIC (%) | 15.0 | 15.0 |

Basic Strategies of 4th Medium-Term Management Plan

Expanding of Business Portfolio

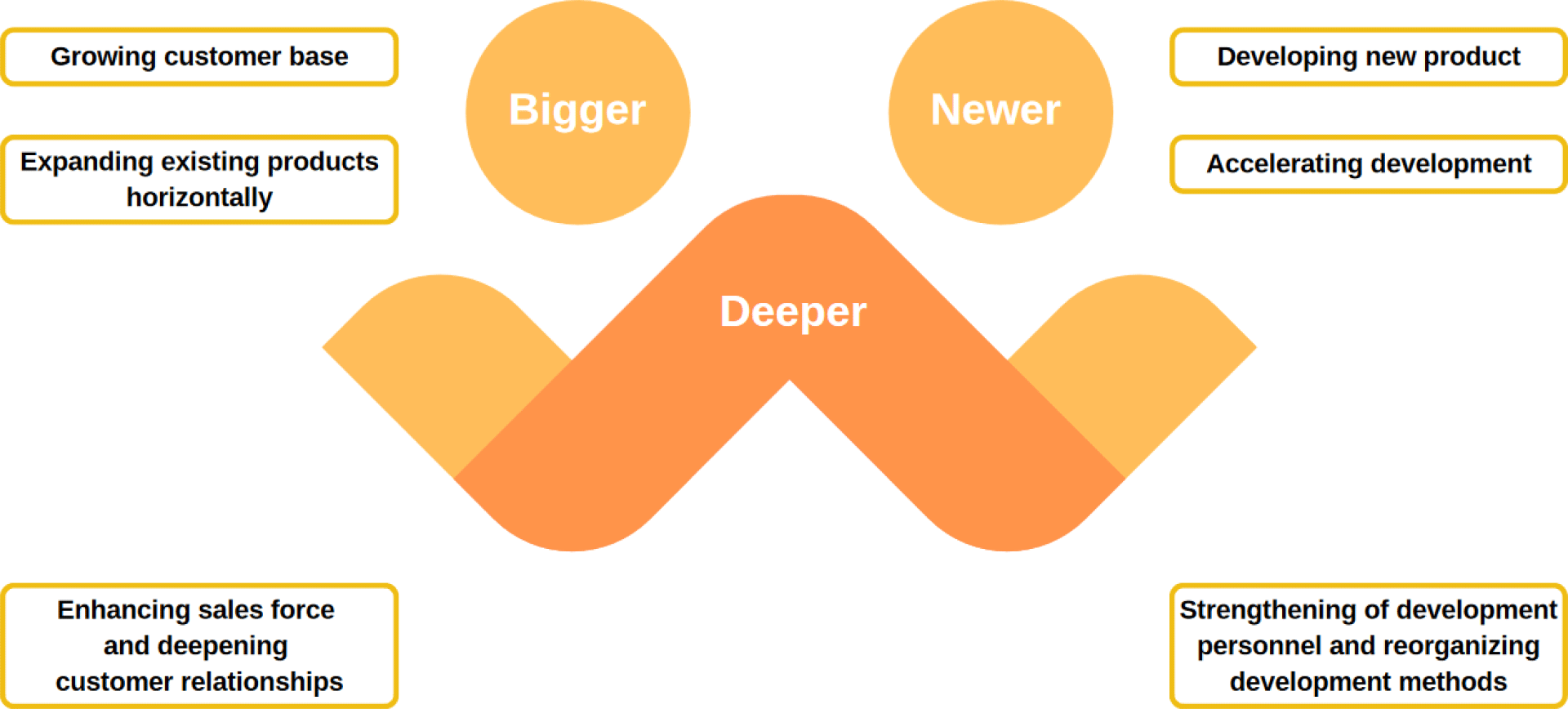

Based on the themes of 'Deeper,' 'Bigger,' and 'Newer,' we aim to expand our business portfolio, targeting net sales of 28 billion yen, operating income of 4.8 billion yen, and ROE and ROIC of over 15%. Additionally, we aim to generate net sales of 2.8 billion yen in FY2026 from new businesses.

Enhancing sales force and deepening customer relationships

Aim to develop existing business areas through account-based selling

Current situation

- Each division covers the whole of Japan

- Our customer base of regional banks is not being fully utilized

Future Prospects

Increase regional cross-selling rates by division

- 2-division cross-selling 40/47 (85.1%) ➝ 95%

- 3-division cross-selling 28/47 (59.6%) ➝ 75%

Advantages of account-based selling

- Aggregate regional information

- Serve as a focal point of businesses driving regional economies

- Propose multiple services

- Strengthen connections with customers

Strengthening development personnel and reorganizing development methods

Aim to shorten delivery times and improve quality by utilizing the latest technologies and alliances

Current situation

- Each employee specializes in a specific product

- Continue conventional development method

Future Prospects

Acquire latest technologies and revamp packages

- Enhance added value by strengthening alliances

- Expand cloud packages

Utilizing the latest technologies and strengthening alliances

- Utilize AI technology effectively

- Promote SaaS models

- Combine with agile development

- Advance Web3.0 initiatives

Growing customer base / Expanding existing products horizontally

Aim to expand existing solutions into new areas, roll out new solutions to existing areas

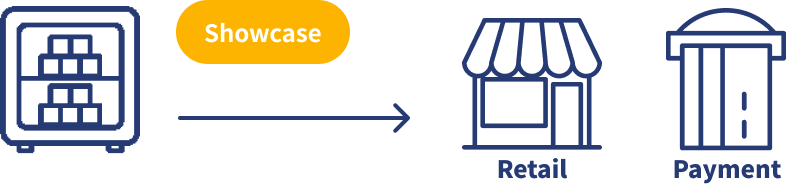

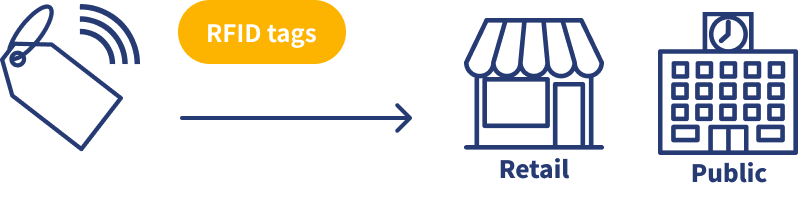

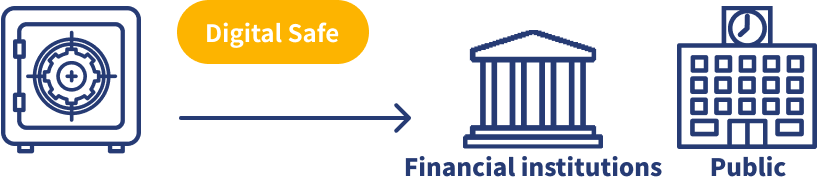

Expanding existing solutions into new areas

Rolling out new solutions in existing areas

Developing new product / Accelerating development

Aim to generate sales of JPY2,800MM in FY2026 from new businesses

Aim to create businesses in the following new areas

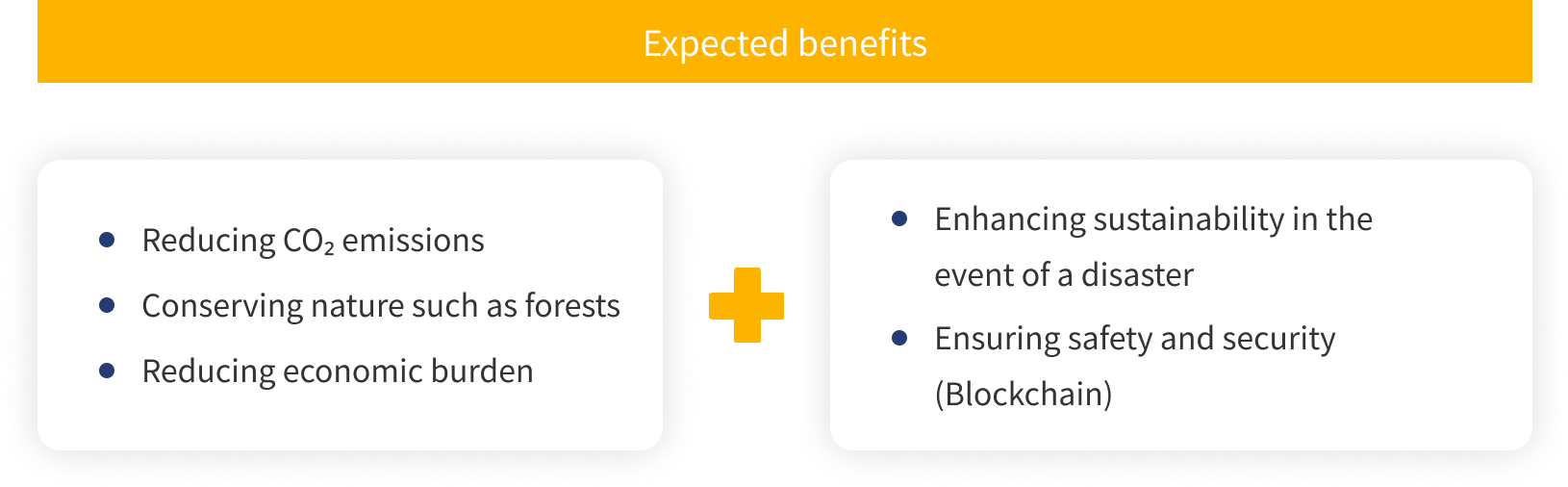

ESG Activities in Our Business Operations

Aim to solve social and environmental issues

Example) Acquiring certificates

-

- CO₂ emissions

- Use of paper

-

- Use of paper

- Personnel allocation

-

- Personnel allocation

- Cash management

- Transportation insurance

-

- CO₂ emissions

- Use of paper

- Personnel allocation

- Transportation insurance

Not only environmentally friendly, equally serviceable in the even to contingency. Creating opportunities for personnel to play an active role in advanced work. Furthermore greatly reducing back-office work and costs

Aim to secure and develop human resources, and related investments

Recruitment

- Recruitment of a diverse range of new graduates

Raising from 30 people (FY2023) to 60 people annually (FY2026) - Recruitment of experienced professionals

- Recruitment of human resources with an eye to new business development

Training

- Enhancement of internal training

- Encouragement of reskilling

Improving engagement score (ES)

- Continuous wage rise

- Enhanced office environment

- Introduction of a stock-based compensation program

- Further improvement of efficiency via DX promotion

Aim to increase recognition and maintain high levels of shareholder returns

Continue to communicate our growth story

- Financial results briefings *Twice a year

- ITFOR Newsletter (information to shareholders) *Twice a year

- Meetings for individual investors

Increase the number of institutional investors

- Targeting to be included in the investment scope of wider spectrum of institutional investors (FY2026)

Reflect dialogue with institutional investors into management as appropriate

- Increasing investor meetings

annual target of 60 meetings in FY2026 from 40 in FY2023 - Sharing and discussing information about investor meetings with management

Shareholder return policy

- Targeting dividend payout ratio of 50%

- Maintaining a total return ratio of over 70%

- Planning to pay dividends twice a year (interim and year-end)

ROIC management

- Setting ROIC target that exceeds the cost of capital

- Reflecting ROIC target in investment decisions

- Withdrawing from businesses that do not meet ROIC target

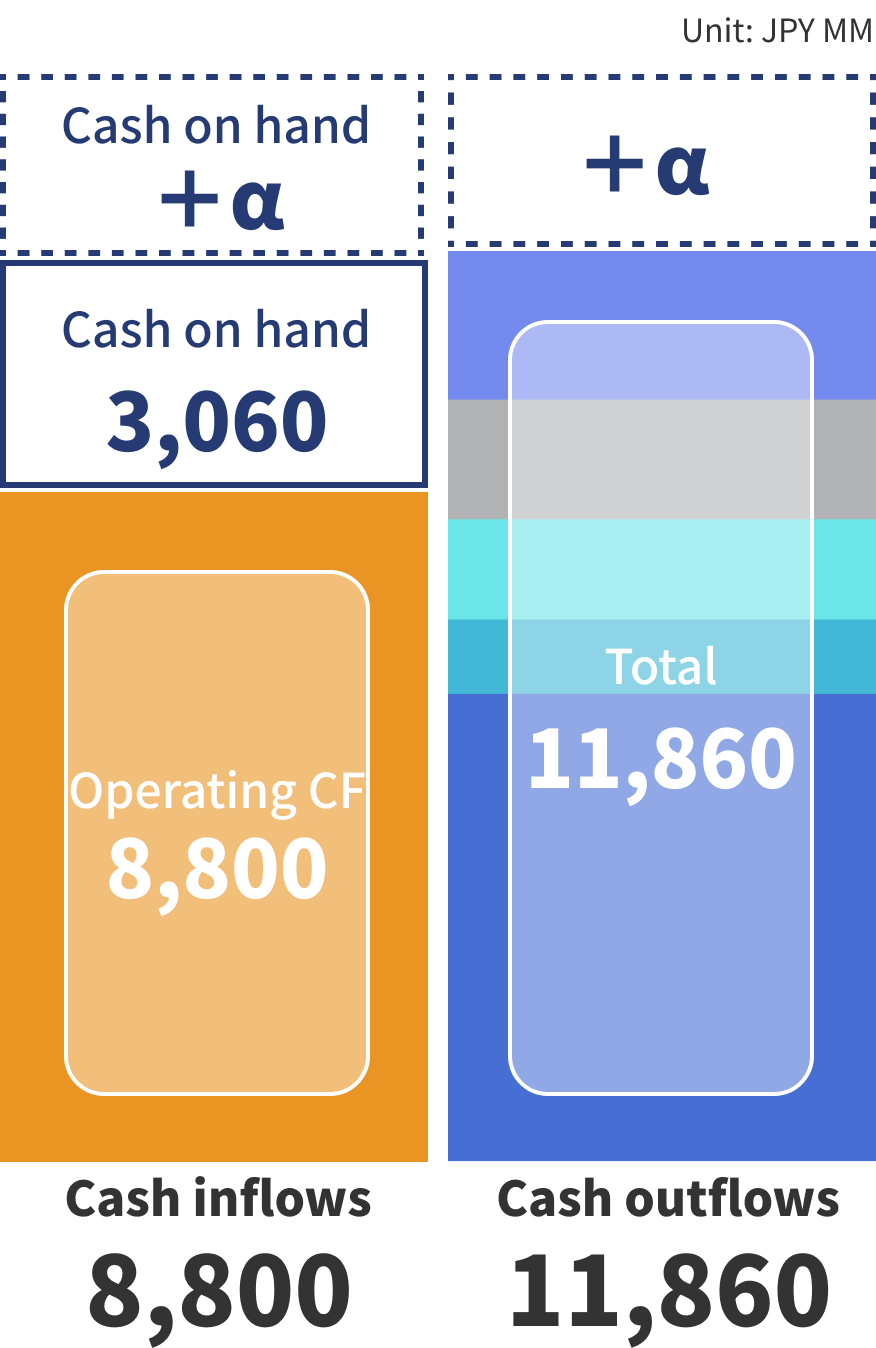

Plan to make shareholder returns and investments more than cash flow

3-year total

- M&A, CVC, etc.

- New business investments 2,000

-

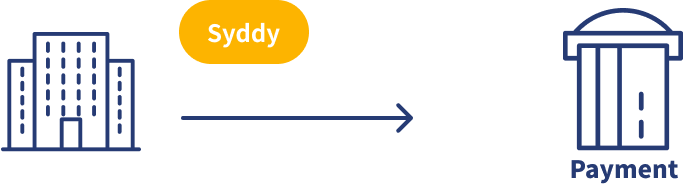

- Investment in VVP business

- Investment in Syddy business

- Investment in ITFOR BeX systems

- Existing business investments 1,500

-

- Upgrade development

- New system development

- Internal investments 1,200

-

- Core systems

- Investment in information security

- Human resource investments 1,000

-

- Investment in human resources (recruitment, training)

- Stock compensation plan

- Shareholder returns 6,160

-

- Target dividend payout ratio of 50%

- Maintain a total return ratio of at least 70%

- Plan to pay dividends twice a year (interim and year-end)