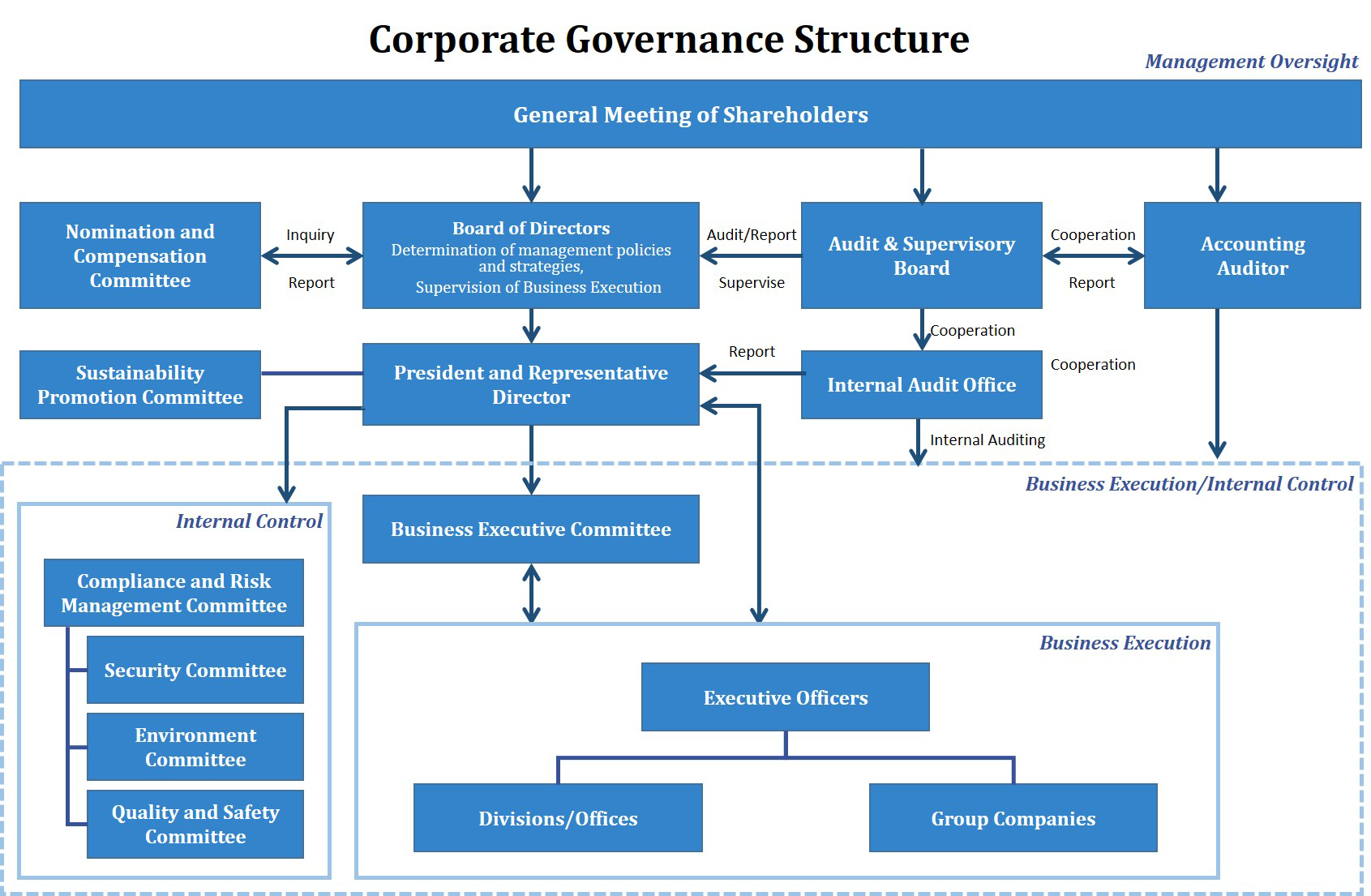

Overview of Corporate Governance Structure

Basic Views on Corporate Governance

Under its corporate philosophy, “Generating excitement and smiles with ‘A Spirit To Be Close’ to people,” the Company recognizes that the basis of corporate governance is to establish transparent and fair management systems and promote efficient business execution based on prompt and decisive decision-making, while providing timely and appropriate information disclosure.

Based on this basic approach, we have established the Company Group's “Basic Policy on Corporate Governance” and aim to continuously improve the corporate value of the Company Group by ensuring the effectiveness and continuous enhancement of corporate governance.

Features of the Corporate Governance System

The Company has adopted the system of a company with an Audit & Supervisory Board to reinforce the supervision function of the Board of Directors and enhance corporate governance.

The Board of Directors, which is the management decision-making and supervision organ of the Company, comprises nine members, namely two Representative Directors, four Directors (excluding Directors serving as Audit & Supervisory Board Members), and three Directors and Audit & Supervisory Board Members. Regular meetings of the Board of Directors are held once per month, and extraordinary meetings of the Board of Directors are held as necessary, in order to implement efficient management decision-making and supervise the execution of duties by Directors through vigorous discussions between Directors who are well-versed in the various businesses of the Group and Outside Directors with a wealth of knowledge from outside the Company.

The Audit & Supervisory Board comprises three Directors and Audit & Supervisory Board Members (one full-time Audit & Supervisory Board Member and two Outside Directors), and meets at least once per month in principle, to audit the status of execution of the duties by Directors, audit financial documents and other materials, create audit reports, and handle other matters. The Audit & Supervisory Board conducts audits in coordination with Ernst & Young ShinNihon LLC, which it selected as its Accounting Auditor, the internal audit division, and other parties, in accordance with the audit policy and audit plans it decided on.

The Company has adopted the executive officer system in order to enable prompt management decisions, by separating management’s decision-making and supervision functions from the business execution function, and delegating all or part of the execution of important business to Directors. Three Directors (excluding Directors serving as Audit & Supervisory Board Members) serve concurrently as Executive Officers, and meetings of the Business Executive Committee, comprising the President and Representative Director and Executive Officers, are held twice per month in principle, in order to flexibly make decisions on basic matters and important matters related to business execution policies.

Furthermore, in order to enhance the fairness, transparency, and objectivity of procedures in relation to nomination and compensation, etc., of Directors, the Company has established the Nomination and Compensation Committee as a voluntary advisory body to the Board of Directors, with a majority of its members consisting of Independent Outside Directors.

Corporate Governance Structure

Constituent Members

| Title | Name | Board of Directors | Business Executive Committee | Audit & Supervisory Board | Nomination and Compensation Committee |

|---|---|---|---|---|---|

| Chairman and Representative Director | Tsunenori Sato | ◎ | ○ | ||

| President and Representative Director | Koji Sakata | ○ | ◎ | ○ | |

| Managing Director and Executive Officer | Hirotaka Oeda | ○ | ○ | ||

| Director and Executive Officer | Katsuo Nakayama | ○ | ○ | ||

| Director and Executive Officer | Kazunori Kono | ○ | ○ | ||

| Outside Director | Waka Abe | ○ | ◎ | ||

| Director and Audit & Supervisory Board Member | Masahito Motoyama | ○ | ◎ | ||

| Outside Director and Audit & Supervisory Board Member | Itsuko Fukuda | ○ | ○ | ○ | |

| Outside Director and Audit & Supervisory Board Member | Koji Kanazawa | ○ | ○ | ○ | |

| Executive Officer | Kenji Kobayashi | ○ | |||

| Executive Officer | Tempei Ogawa | ○ | |||

| Executive Officer | Go Yoshimura | ○ | |||

| Executive Officer | Takehiro Ikeda | ○ | |||

| Executive Officer | Kenji Hashimoto | ○ |

◎: chairperson

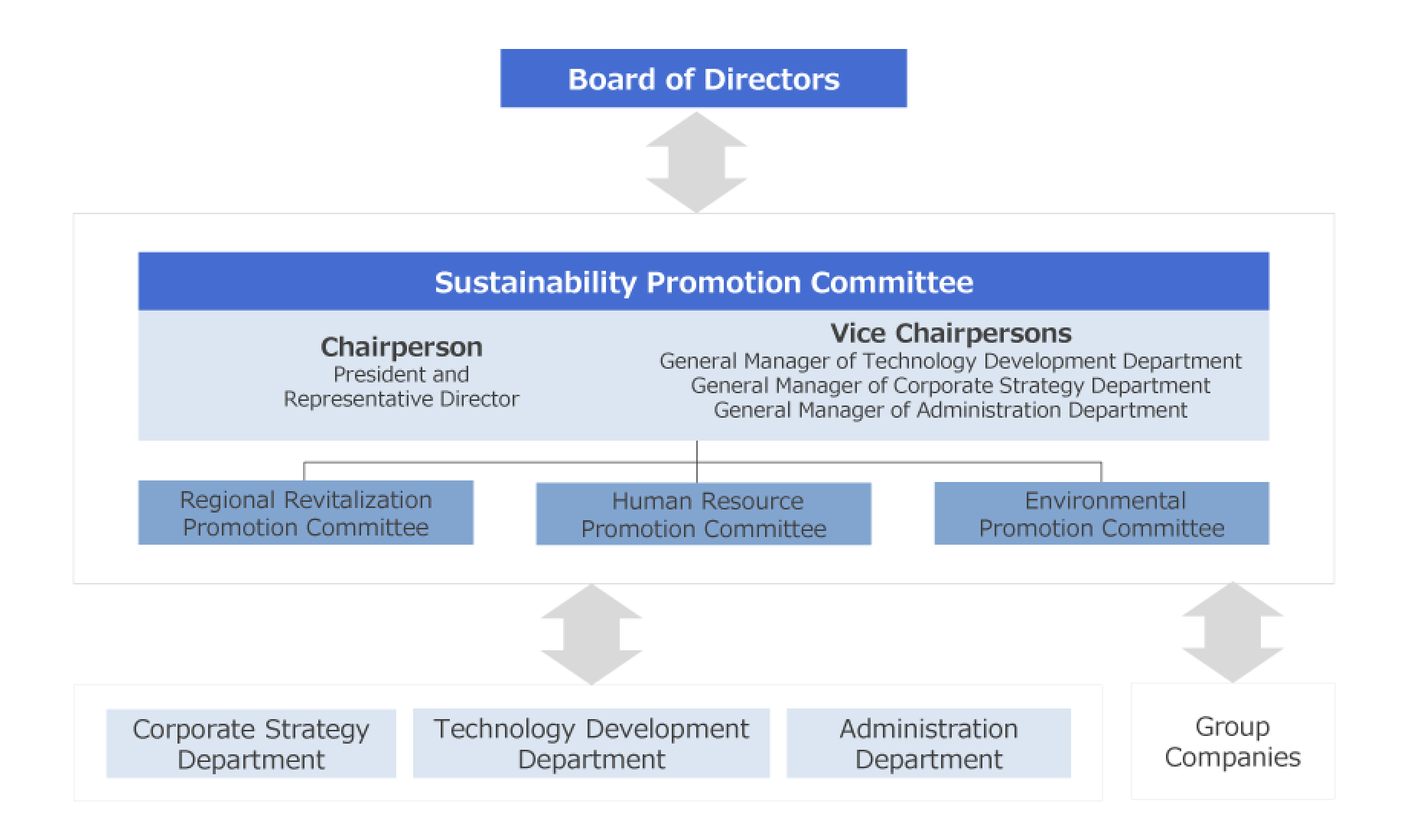

Promotional System

Sustainability Promotion Committee Members

| Title | Constituent Members |

|---|---|

| Chairperson | Chairman and Representative Director |

| Vice Chairperson | President and Representative Director |

| Members | Employees from Technology Department: 8 (including 2 women) |

| Employees from Corporate Strategy Department: 10 (including 0 women) | |

| Employees from Administration Department: 5 (including 4 women) |

Takeover Defense Measures

At the Company's 47th Annual Meeting of Shareholders, which was held on June 23, 2006, the Company introduced takeover defense measures in order to protect its corporate value and the common interests of shareholders. Since then, the Company had continued with the measures by revising them as necessary, but in accordance with the decision of the Company's Board of Directors meeting held on May 12, 2022, the takeover defense measures were discontinued and abolished as of the end of the 63rd Annual General Meeting of Shareholders.

The Company will work to enhance the Group's corporate value as well as secure and enhance the common interests of shareholders, and will take appropriate measures within the bounds of the Financial Instruments and Exchange Act, the Companies Act, and other related laws and regulations with respect to parties which seek to make a large-scale acquisition of the Company's shares, demanding necessary and sufficient provision of information for shareholders to make an appropriate decision on the advisability of the large-scale acquisition and disclosing the opinions, etc., of the Board of Directors, with the aim of securing and enhancing the Group's corporate value and the common interests of shareholders.