Review of 3rd Medium-Term Management Plan

Summary of 3rd Medium-Term Management Plan

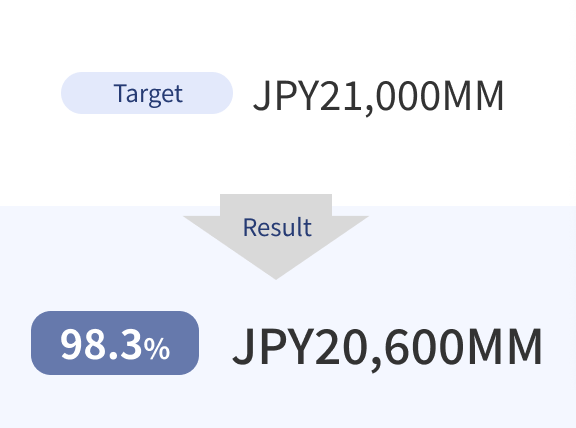

Net sales

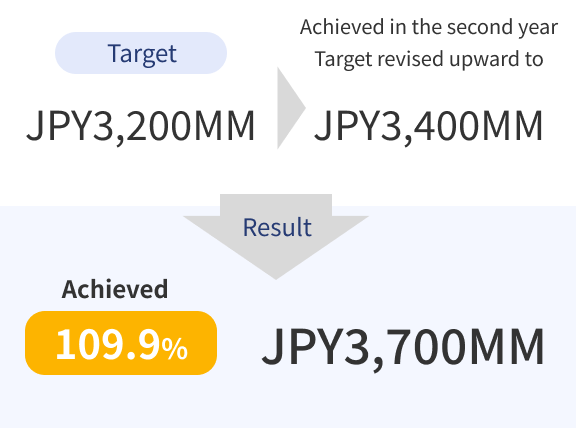

Operating income

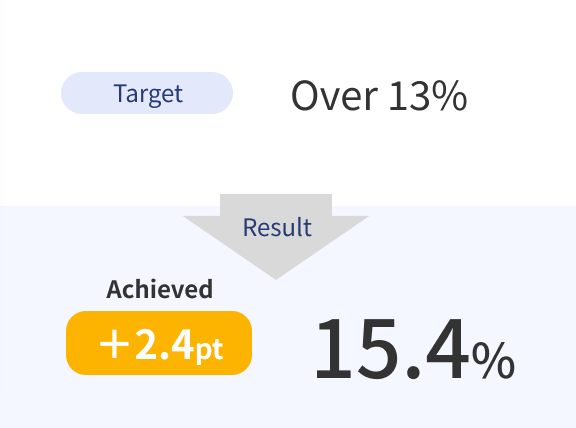

ROE

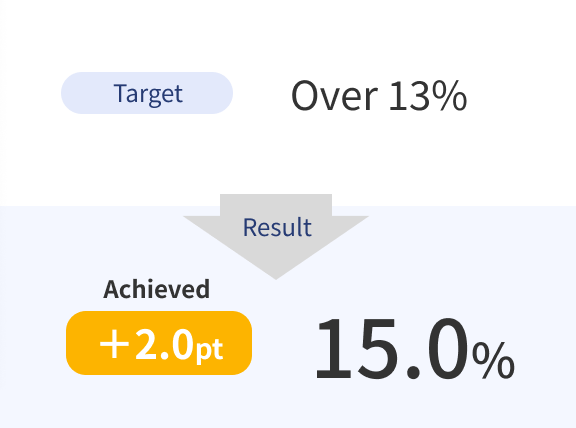

ROIC

Sales by Segments

Solid growth in Financial Systems

Sales of Public Systems declined due to the impact of the standardization for regional governments system

Steady growth in Recurring sales along with growth in System Development and Sales

| (JPY MM) | FY2021 | FY2022 | FY2023 | FY21-23 Change |

|

|---|---|---|---|---|---|

System Development and Sales |

Financial Systems | 4,954 | 4,966 | 5,197 | 104.9% |

| Public Systems | 501 | 368 | 489 | 97.6% | |

| Retail EC Systems | 705 | 645 | 1,006 | 142.5% | |

| CTI Systems | 989 | 1,200 | 1,317 | 133.2% | |

| Communication Systems | 934 | 1,210 | 1,300 | 139.1% | |

| Payment Systems | 1,429 | 1,543 | 1,945 | 136.1% | |

| Others | 338 | 678 | 859 | 253.8% | |

Recurring |

BPO | 3,103 | 3,499 | 3,869 | 124.7% |

| Maintenance, Usage Fees | 4,062 | 4,210 | 4,665 | 114.8% |

Basic Policy Achievements and Issues

Financial Targets have been mostly achieved

Certain issues shall be continued to be addressed

Reinforcing Management Base

- Reform organization and systems

- Strengthen internal collaborations

- Promote internal DX

- Strengthen HR

- Strengthen Development

-

- Flexible and continuous organizational restructuring

- Renewal of HR system

- Digitalization of internal procedures

-

- Room for collaboration between sales and development

- Room for collaboration among sales divisions

- Carryover of internal core systems renewal

- Room for investment in HR

Enhancing Profitability

- Introduce ROIC management

- Reform monitoring

- Investment/Exit rules

- Synergies among divisions

- Investment in new and growing businesses

-

- Increase in the frequency of management indicator monitoring

- Expansion of cross-selling

- Divestiture of an affiliate company

-

- Wider penetration of ROIC by business lines

- Thorough implementation of investment/exit rules

- Pursuit of further synergies among divisions

- Explored M&As as investments in new and growing businesses, but efforts did not materialize

Advancing ESG Management

- Designate officer

- Make significant changes in current approach

-

- Publication of Integrated Report

- Establishment and enhancement of the Sustainability Promotion Committee

- Stronger regional connections

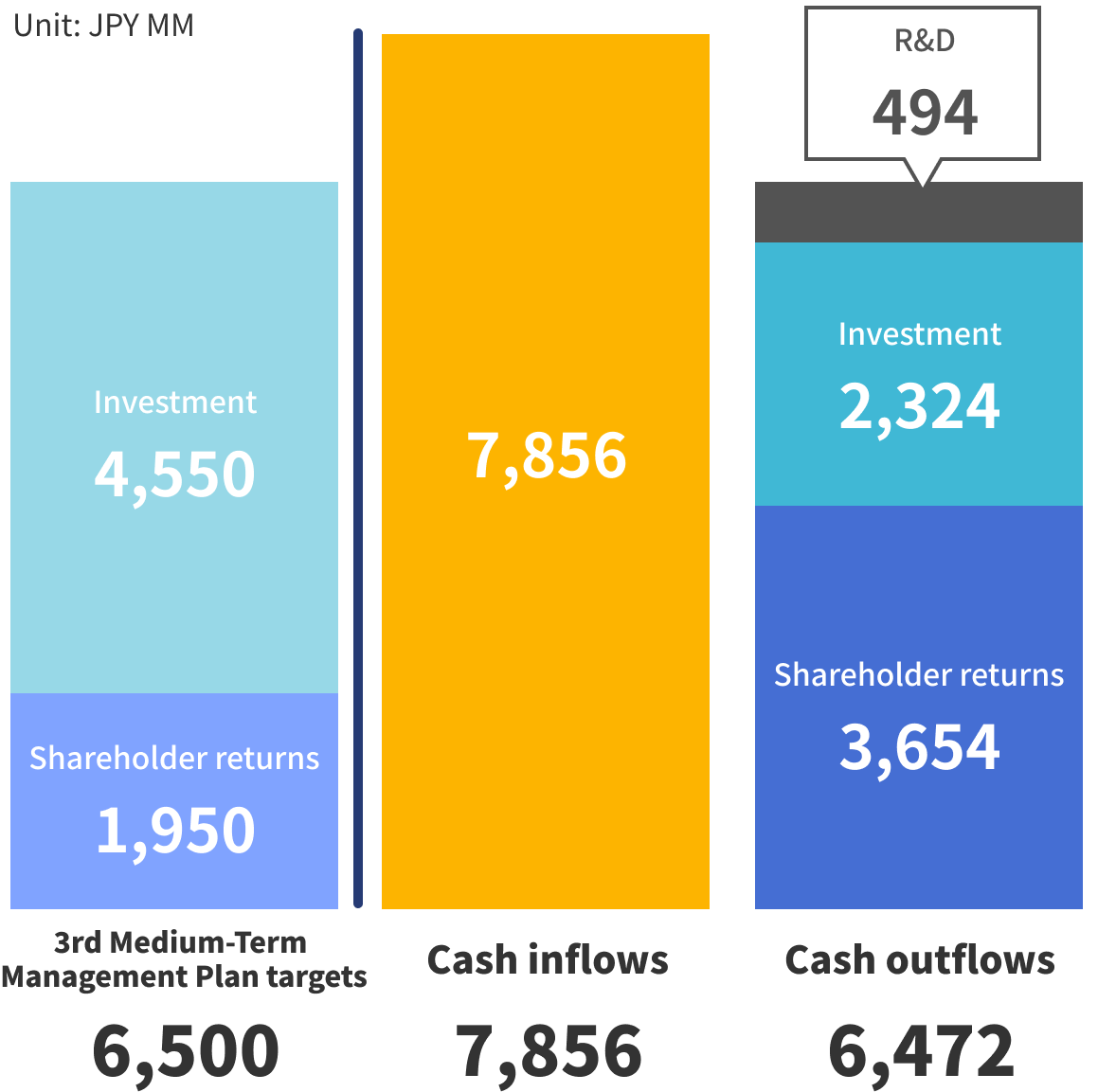

Cash Allocation

Growth investments and shareholder returns exceeding plan

3-year total

- R&D 494

-

- R&D for new payment terminals

- R&D for SaaS applications

- R&D for Web 3.0 technology applications

- Investment 2,342

-

- Improvement of office environment (including remote work environment)

- Source control system updates

- Investment related to HR recruitment

- Investment related to packaged software upgrades

- Shareholder returns 3,645

-

- Executed the largest-ever purchase and cancellation of treasury stock of JPY900MM

- Announced a new policy targeting a dividend payout ratio of 50% and a total return ratio of over 70%

- Achieved a total return ratio of 71.8% and provided total returns of JPY1,988MM in FY2023