Corporate Governance

Basic Views on Corporate Governance

Under its corporate philosophy, “We provide inspiration and innovation for a future of smiles through our ‘ability to be close to people’,” the Company recognizes that the basis of corporate governance is to create transparent and fair management systems and promote efficient business execution based on prompt and decisive decision-making, while providing timely and appropriate information disclosure.

Based on this basic approach, we have established the ITFOR Group's "Basic Policy on Corporate Governance" and aim to continuously improve the corporate value of the Group by ensuring the effectiveness and continuous enhancement of corporate governance.

Basic Policy on Corporate Governance

(revised on June 28, 2022)444KB

Corporate Governance Report (released

on June 28, 2022)917KB

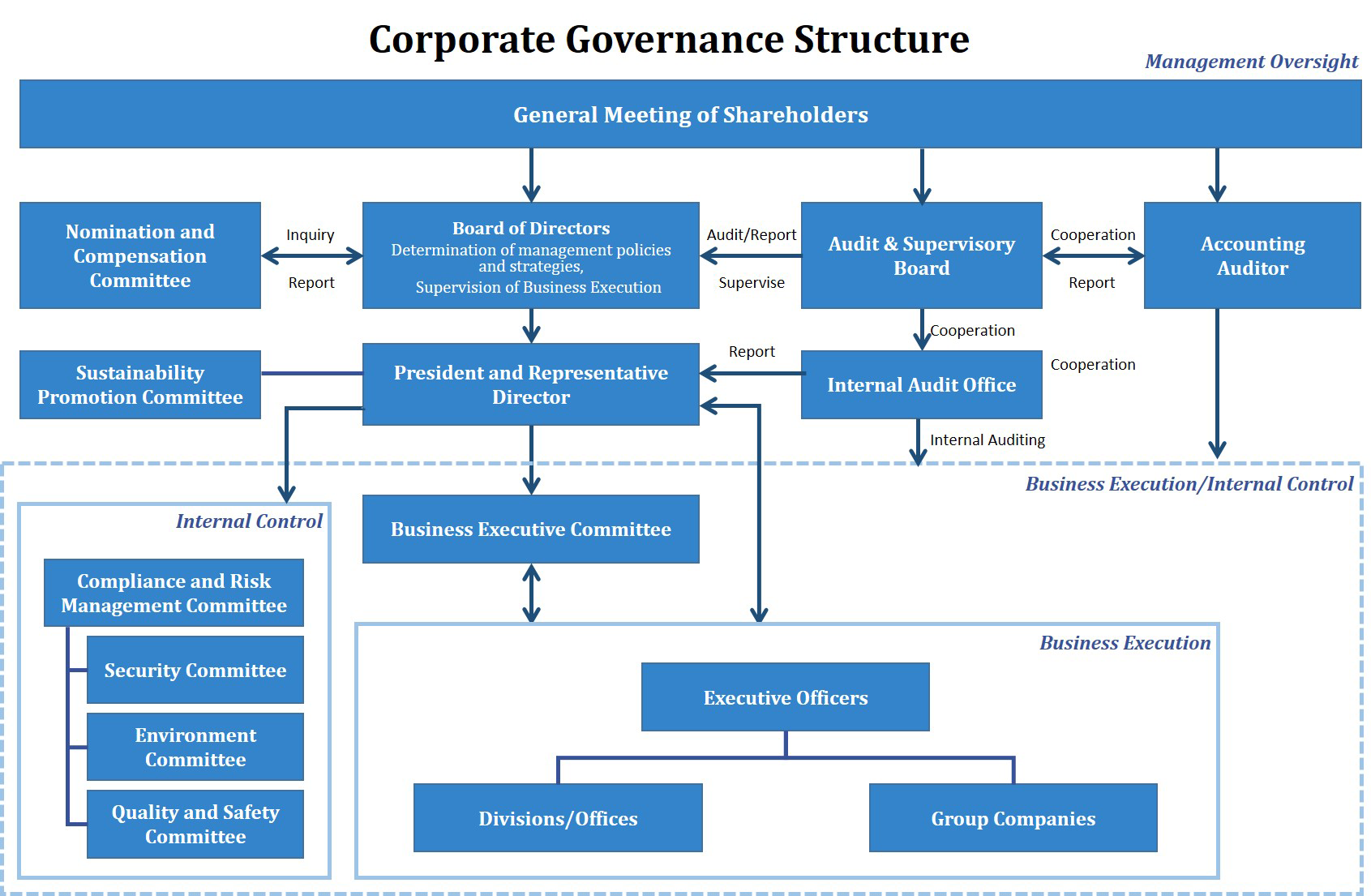

Features of the Corporate Governance System

The Company has adopted the system of a company with an Audit & Supervisory Board to reinforce the supervision function of the Board of Directors and enhance corporate governance.

The Board of Directors, which is the management decision-making and supervision organ of the Company, comprises eight members, namely two Representative Directors, three Directors (excluding Directors and Audit & Supervisory Board Members), and three Directors and Audit & Supervisory Board Members. Regular meetings of the Board of Directors are held once per month, and extraordinary meetings of the Board of Directors are held as necessary, in order to implement efficient management decision-making and supervise the execution of duties by Directors through vigorous discussions between Directors who are well-versed in the various businesses of the Group and Outside Directors with a wealth of knowledge from outside the Company.

The Audit & Supervisory Board comprises three Directors and Audit & Supervisory Board Members (one full-time Audit & Supervisory Board Member and two Outside Directors), and meets at least once per month in principle, to audit the status of execution of the duties by Directors, audit financial documents and other materials, create audit reports, and handle other matters. The Audit & Supervisory Board conducts audits in coordination with Ernst & Young ShinNihon LLC, which it selected as its Accounting Auditor, the internal audit division, and other parties, in accordance with the audit policy and audit plans it decided on.

The Company has adopted the executive officer system in order to enable prompt management decisions, by separating management’s decision-making and supervision functions from the business execution function, and delegating all or part of the execution of important business to Directors. One Representative Director and two Directors (excluding Directors and Audit & Supervisory Board Members) serve concurrently as Executive Officers, and meetings of the Business Executive Committee, comprising the Representative Director and Executive Officers, are held twice per month in principle, in order to flexibly make decisions on basic matters and important matters related to business execution policies.

Furthermore, in order to enhance the fairness, transparency, and objectivity of procedures in relation to nomination and compensation, etc., of Directors, the Company has established the Nomination and Compensation Committee as a voluntary advisory body to the Board of Directors, with a majority of its members consisting of Independent Outside Directors.

- The Board of Directors, which is the management decision-making and supervision organ of the Company,

comprises eight members, namely two Representative Directors, three Directors (excluding Directors and

Audit & Supervisory Board Members), and three Directors and Audit & Supervisory Board Members. Regular

meetings of the Board of Directors are held once per month, and extraordinary meetings of the Board of

Directors are held as necessary, in order to decide important matters provided for in laws and

regulations and the Articles of Incorporation, as well as to supervise the business execution status of

the Directors.

In addition, one Representative Director and two Directors (excluding Directors and Audit & Supervisory Board Members) serve concurrently as Executive Officers, and the meetings of the Business Executive Committee, comprising the Representative Director and Executive Officers, are held twice per month in principle, to deliberate and decide matters related to business execution policies. - The Audit & Supervisory Board comprises three Audit & Supervisory Board Members, including two Outside Directors, and meets at least once per month in principle, to audit the status of execution of the duties of the Directors, among other matters.

- The Company has selected Ernst & Young ShinNihon LLC as its Accounting Auditor, from whom it receives accounting audits as well as instructions and advice, as necessary.

| Number of Directors Stipulated in the Articles of Incorporation | 20 |

|---|---|

| Term of Office of Directors Stipulated in the Articles of Incorporation | 1 year |

| Chairperson of the Board of Directors | President |

| Number of Directors | 8 |

| Number of Outside Directors | 3 |

| Number of Outside Directors designated as Independent Directors | 3 |

| Number of Directors and Audit & Supervisory Board Members Stipulated in the Articles of Incorporation | No more than 5 |

|---|---|

| Number of Directors and Audit & Supervisory Board Members | 3 |

| Composition of the Audit & Supervisory Board Members | 1 Internal Director and 2 Outside Directors |

| Chairperson | An Internal Director |

Takeover Defense Measures

At the Company's 47th Annual Meeting of Shareholders, which was held on June 23, 2006, the Company

introduced takeover defense measures in order to protect its corporate value and the common interests of

shareholders. Since then, the Company had continued with the measures by revising them as necessary, but

in accordance with the decision of the Company's Board of Directors meeting held on May 12, 2022, the

takeover defense measures were discontinued and abolished as of the end of the 63rd Annual General Meeting

of Shareholders.

The Company will work to enhance the Group's corporate value as well as secure and enhance the common

interests of shareholders, and will take appropriate measures within the bounds of the Financial

Instruments and Exchange Act, the Companies Act, and other related laws and regulations with respect to

parties which seek to make a large-scale acquisition of the Company's shares, demanding necessary and

sufficient provision of information for shareholders to make an appropriate decision on the advisability

of the large-scale acquisition and disclosing the opinions, etc., of the Board of Directors, with the aim

of securing and enhancing the Group's corporate value and the common interests of shareholders.

Internal Control System

The Company’s Board of Directors has resolved the basic policy on the establishment of the internal control system, as follows.

-

System to ensure that the execution of duties by the Directors and employees of the Company and its

subsidiaries is in conformity with laws and regulations and the Articles of Incorporation

- (1) The Company shall establish the “Compliance and Risk Management Committee” as an organization to oversee the Company Group’s compliance, as a whole.

- (2) To thoroughly enforce compliance with laws and regulations and the Articles of Incorporation among the Directors and employees of the Company and its subsidiaries, the Compliance and Risk Management Committee shall conduct periodic in-house education on compliance, and also manage and supervise the implementation status of compliance, and establish a system to report such activities to the Board of Directors and the Audit & Supervisory Board, as necessary.

- (3) To promote compliance, instructions shall be given through training and other methods, based on the compliance regulations, to ensure that the Directors and employees of the Company and its subsidiaries take individual ownership of the problem of compliance, and engage in business operations accordingly.

- System for the storage and management of information related to the Directors’ execution

of duties, and system for reporting matters related to the execution of duties by the Directors of

subsidiaries to the Company

Information related to the Directors’ execution of duties shall be appropriately stored and managed in a readily accessible form, in accordance with the provisions of the document management regulations. In addition, at the subsidiaries, matters to be approved by and reported to the Company’s Board of Directors or the Business Executive Committee shall be set forth in the affiliate management regulations and the authority regulations. -

Regulations and other systems concerning management of the risk of loss for the Company and its

subsidiaries

- (1) The Company shall establish the “Compliance and Risk Management Committee” as an organization to oversee risk management in general, as well as an “Emergency Response Headquarters” headed by the President, to oversee risk management in times of emergency for the Company and its subsidiaries.

- (2) In normal times, the Company shall make efforts to mitigate risks associated with information security, the environment, occupational health, product safety, quality, etc. through risk analysis based on the risk management regulations.

- (3) The Company shall establish the “Security Committee,” “Environment Committee,” and “Quality and Safety Committee” under the “Compliance and Risk Management Committee,” to analyze operational risks from their respective specialized standpoints and report to the “Compliance and Risk Management Committee.” The Company shall also conduct in-house training and other methods to firmly establish risk management.

-

System for ensuring that the Directors of the Company and its subsidiaries perform their duties

efficiently

- (1) In accordance with the provisions of laws and regulations and the Articles of Incorporation, the Company shall convene a meeting of the Board of Directors once per month, in principle, or whenever necessary, regarding important matters related to the management of the Company and its subsidiaries, in order to resolve such matters upon conducting the necessary and appropriate discussions and deliberations, and to supervise the execution of the duties of the Directors.

- (2) To further strengthen the functions of the Board of Directors and improve management efficiency, the Company shall convene meetings of the Business Executive Committee each month, as appropriate, with the attendance of all Directors and Executive Officers, in order to flexibly make decisions on basic matters and important matters related to business execution.

- (3) Directors (excluding Directors and Audit & Supervisory Board Members) shall establish organizational structures with clearly defined responsibilities and authorities under their chain of command, in accordance with the division of duties regulations and the authority regulations, and respond to important issues promptly and flexibly.

-

System to ensure the appropriateness of business conducted by the corporate group comprising the Company

and its subsidiaries

- (1) The Company shall assign a person in charge of compliance to each subsidiary, while the “Compliance and Risk Management Committee” shall carry out management and supervision of compliance of the Company Group, in general.

- (2) The Company shall manage, instruct, and audit the subsidiaries, in accordance with the affiliate management regulations, and conduct periodic reports and discussions in order to understand their business status.

- (3) The Company’s Directors (excluding Directors and Audit & Supervisory Board Members) shall serve concurrently as Directors of the subsidiaries, in order to improve the business efficiency of the entire Group and enhance the risk management system, by means such as securing opportunities to report on important issues and responses to newly-recognized risks, as necessary, at the management meetings of each of its subsidiaries.

-

Items concerning Directors and employees who assist in the duties of the Audit & Supervisory Board of

the Company, items concerning the independence of such Directors and employees from other Directors

(excluding Directors and Audit & Supervisory Board Members), and items concerning ensuring the

effectiveness of instructions given to such Directors and employees by the Audit & Supervisory Board

- (1) When deemed necessary by the Audit & Supervisory Board, employees shall be assigned to assist in its duties, and such assignments shall be made with reference to the opinions of the Audit & Supervisory Board.

- (2) Personnel matters (transfers, evaluations, disciplinary actions, etc.) of employees assigned to assist in the duties of the Audit & Supervisory Board shall be deliberated in advance by the Audit & Supervisory Board and the Human Resources Division.

- (3) When assisting in the duties of the Audit & Supervisory Board, employees who have been assigned to such duties shall be under the command and control of the Audit & Supervisory Board.

- System for reporting to the Audit & Supervisory Board and system to ensure that

individuals who have reported to the Audit & Supervisory Board are not disadvantageously treated as a

result of such reports

When requested by the Audit & Supervisory Board, Directors and employees of the Company and its subsidiaries shall attend the meetings of the Audit & Supervisory Board and provide explanations regarding relevant matters. Furthermore, Directors and employees of the Company and its subsidiaries shall report without delay to the Audit & Supervisory Board Members, not only regarding matters provided for by laws and regulations, but also when facts that could cause significant damage to the Company or its subsidiaries are discovered or reported.

The Company and its subsidiaries shall establish rules to the effect that individuals who have made reports to the Audit & Supervisory Board Members shall not be treated unfairly due to such reports, and ensure that such rules are enforced. - Items concerning procedures for advance payment or reimbursement of costs incurred in

relation to execution of the duties of Audit & Supervisory Board Members (limited to those related to

execution of the duties of the Audit & Supervisory Board) and other policies on the treatment of costs

and debts arising from execution of such duties

Audit & Supervisory Board Members may request the Company for advance payment or reimbursement of costs incurred, and the payment of debt to creditors borne in relation to the execution of duties. The Directors (excluding Directors and Audit & Supervisory Board Members) shall settle said costs or debts without delay, except in cases where any doubt arises regarding whether or not said costs or debts were necessary for the execution of duties by Audit & Supervisory Board Members, and shall ensure that sufficient audits are not hindered. - Other systems to ensure that the Audit & Supervisory Board’s audits are executed effectively

The Audit & Supervisory Board may attend relevant meetings and freely access various materials in order to acquire the information necessary for audits. The Audit & Supervisory Board shall make efforts to exchange information with the Accounting Auditor, the corporate attorneys, and the Corporate Auditors of each subsidiary, and collaborate to ensure the effectiveness of the audits of the Company and its subsidiaries.

Exclusion of Anti-social Forces

The Company has established the “Basic Policy on the Exclusion of Anti-social Forces” as follows, and has set up a system to maintain a resolute stance against anti-social forces.

- 〈Basic Policy on the Exclusion of Anti-social Forces〉

-

- The Company is fully aware of the importance of severing all ties with anti-social forces that threaten the social order and the sound business operations of corporations, from the perspectives of social responsibility, compliance, and corporate defense, and rejects all ties with such forces and provides no benefit to them.

- The Company shall steadfastly refuse all unjust demands by anti-social forces. Furthermore, the Company shall address such unjust demands as an organization, and take a resolute stand.

- The Company shall always strive to strengthen its collaboration with outside specialist organizations such as the police, so that it will be able to receive appropriate advice and cooperation in the event that it receives an unjust demand from anti-social forces.

- 〈Development of a System for the Exclusion of Anti-social Forces〉

-

The Company has established the following systems to sever any and all ties with anti-social forces.

- Appointment of a manager in charge of preventing unjust demands, and collaboration with corporate attorneys, local police stations, and Public Interest Incorporated Association Special Anti-violence Countermeasures Federation of the Metropolitan Police Department (Tokubouren)

- Membership in Tokubouren and gathering of information through the Tokubouren newsletters and Tokubouren news, and through participation in workshops sponsored by Tokubouren

Implementation of Measures for Shareholders and Other Stakeholders

- ◆ Initiatives to revitalize the General Meeting of Shareholders and facilitate the exercise of voting rights

-

The convocation notices for the Annual General Meeting of Shareholders held on June 21, 2024 were sent out on June 3, before the statutory date. On May 29, the convocation notice was posted on the Tokyo Stock Exchange website (TDnet) and the Company’s IR website.

[General Meeting of Shareholders] https://ir.itfor.co.jp/english/stock/meeting.html

In addition, an English version of the convocation notice has also been prepared. It has been voluntarily posted on TDnet on June 3 and posted on the Company’s IR website as well.

▸ NOTICE OF THE 65th ANNUAL GENERAL MEETING OF SHAREHOLDERS

( https://pdf.irpocket.com/C4743/BbNL/dOfq/yTu9.pdf )To enhance the convenience of the shareholders, the Company has adopted the method of exercising voting rights through electronic means, and from the Annual General Meeting of Shareholders held on June 19, 2020, the Company has been utilizing an electronic voting platform.

- ◆ IR activities

-

The Company upholds the “appropriate disclosure of information” as part of its Corporate Code of Conduct. The Company maintains and ensures the continuity of transparent management and appropriately discloses corporate information, not only as a means of complying with laws and regulations, but also as a way to gain the trust of its customers, shareholders, and investors.

The Company holds briefings on the financial results for institutional investors and analysts twice each year.

These briefings are conducted by the President, and videos of the briefings as well as the presentation materials used are posted on the Company’s IR website.[Video library] https://ir.itfor.co.jp/individual/movie.html (Japanese)

[Financial results materials] https://ir.itfor.co.jp/english/library/documents.htmlThe Company posts financial information and timely disclosures, management policies, stock information, and other information on its IR website.

https://ir.itfor.co.jp/english/The Corporate Planning Department has been assigned to oversee IR functions. Actual IR activities are carried out in collaboration with the Director and General Manager of the Administration Department, and the Corporate Planning Department.

- ◆ Initiatives to ensure due respect to stakeholders

The Corporate Code of Conduct defines the appropriate disclosure of information as well as the

initiatives to be taken to address environmental issues.

Based on its recognition of the importance of issues surrounding sustainability, the Company is actively

and positively advancing initiatives for the realization of a sustainable society. In December 2021, the

Company formulated a basic policy on sustainability and has posted the details of its activities and

other related topics on the Company’s website.

[Corporate Code of Conduct] https://www.itfor.co.jp/company/policy/code/

(Japanese)

[Sustainability] https://www.itfor.co.jp/en/sustainability/